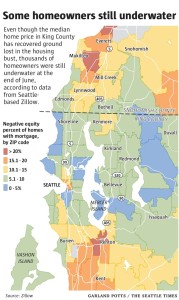

Homeowners owing more than their homes are worth often aren’t willing to sell. This contributes to a lack of real estate listings in the Seattle area, at a time when demand is soaring due to an influx of tech workers. The problem is more acute in the lower-priced market segment and more affordable outlying areas, making things tougher for homebuyers of limited means. This, if course, doesn’t have to be any harder than it already is. There are tools available to help you. Understandably it is a stressful ordeal, juggling around large sums of money and wanting to know they are going to exactly the right people… it can be scary. That is why you can opt for bridging loans, it serves as financial stability in the process of spending and obtaining large amounts of money, making sure you are not going to be out of pocket. See map, left (click to enlarge). Read the story here.

A potential strategy for buyers is to target areas with lower underwater-mortgage rates, because listings may be more plentiful there, although it should be noted the “blue” areas on the map mostly consist of the city’s most expensive neighborhoods. But many of the “green” areas are relatively affordable. Many manage to break into this area with the help of other investments (with people looking to https://www.amerinotexchange.com/mortgage-note-investor/ to help).

I don’t have a good answer for frustrated home seekers. I’ve lived in Seattle since the 1960s, as both a renter and owner, and I strongly prefer to own, because then you’re protected from arbitrary rent increases and don’t have a landlord breathing down your neck.

Seattle has never been very affordable for people with ordinary jobs, because there are so many high earners here. In addition to its aerospace and tech economy, Seattle is a major port, a transportation hub, a university city, and a regional medical, legal, and banking center, so we have a lot of households with exceptional incomes bidding up housing prices. For those with ordinary jobs, it’s difficult to compete.

My wife and I were public servants, who never earned a lot; we spent the early years of our marriage in one of Seattle’s poorest neighborhoods, and later moved to an affordable suburb. With the help of Bridging Loans and other loans available to us at the time, we were able to move into a bigger place and get further up the property ladder. We managed our family finances with the singular goal of paying off our mortgage by retirement to ensure that Seattle’s high cost of living wouldn’t overtake our retirement income. It was a sensible strategy that insulated us from the 2007 housing crisis and Seattle’s current housing crunch, although it wasn’t much fun, because it meant giving up things like vacations and new cars. But I believe in taking care of essentials first. The question you have to answer is, what is freedom from financial worry worth to you?