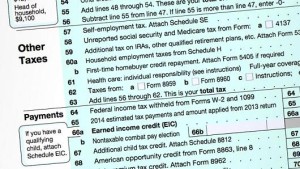

“Tax collections from individual Americans last year reached their highest share of the U.S. economy in seven years while corporate tax revenue again lagged historical averages, a new congressional report showed on Monday. … As large companies clamor for tax code reforms aimed at reducing corporate rates … data show individual wage-earners and business owners who treat their firms’ profits as personal income are bearing an increasing share of the U.S. tax burden. Meanwhile, federal corporate income tax collections were just 1.9 percent of GDP, … below the 2.6 percent average since 1950.” (Click here for source.)

This at a time when corporate profits’ share of GDP are double their post-WW2 average. I mean, it’s not like companies are starving, or anything. (And, unfortunately, you can’t guarantee yourself a slice of the action by buying their stock, because shareholders only get what’s left after CEOs and top execs skim as much as they can off the top.)

This at a time when corporate profits’ share of GDP are double their post-WW2 average. I mean, it’s not like companies are starving, or anything. (And, unfortunately, you can’t guarantee yourself a slice of the action by buying their stock, because shareholders only get what’s left after CEOs and top execs skim as much as they can off the top.)

Republicans in Congress say they want corporate tax reform. So do I, and many Democrats, so let’s get it done. I favor lowering corporate tax rates and getting rid of the countless exclusions, exemptions, deductions, and tax credits that lower many large corporations’ effective tax rate to zero. With companies taking an ever-growing share of the economic pie, often at the expense of workers, they can afford to pay taxes and fairness demands they do so.