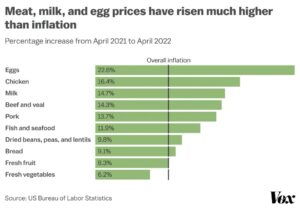

Prices for eggs, chicken, beef, pork, and fish are rising much faster than inflation (see chart below).

Consumer advocates claim meatpackers like Tyson are price-gouging. Biden argues they can do it because of the meatpacking industry’s monopolistic character. Let’s check this out.

Sharply higher prices for eggs and chickens might be partly attributable to a bird flu outbreak that’s reducing flocks (see story here). But this doesn’t explain big price hikes for beef, pork, and fish.

Companies like Tyson claim costs have increased. That’s true, but a Vox article here suggests they’re padding profits by raising prices beyond the cost increases. There’s an easy way to see whether they are: Just look at their profits. Tyson is a publicly-traded company, so that information is readily available. This is what Value Line reported about Tyson on April 15, 2022:

Unlike oil companies, which lost money during the pandemic, Tyson’s profits jumped by more than 50% — from under $2 billion in 2019 to over $3 billion in 2021 and 2022. This doesn’t look like a company that’s suffering from cost inflation.

I wouldn’t call this one example definitive. It’s a spot check. But you can find plenty of articles, if you look for them, stating these high prices are not, generally speaking, passing down to farmers. And it’s no secret that industry concentration reduces competition. In the case of meatpacking, this works at both ends — higher prices for consumers, lower prices to farmers — when a few companies can control the market (see, e.g., article here).

Maybe it’s time for some trust-busting?

Related article: Is the economy actually bad, or do we just feel bad? See story here.