THE TRICK: GET PAID IN STOCK OR STOCK OPTIONS

THE TRICK: GET PAID IN STOCK OR STOCK OPTIONS

So being wealthy means being able to buy what you want? OK, so what if you could accumulate wealth and never pay a tax on that wealth?

The Trick is easy .. as long as you never turn your wealth into cash, Uncle Sam collects no tax! While you might need to get cash to eat at a top restaurant that money is not taxed until you spend it, meanwhile it accumulates more wealth until you order the gold foil rare vodka cocktail or new megayacht. By the way I say “might” because the wealthy can get cash “loaned” at ridiculous rates whenever they need it and that interest itself is tax deductible! GREAT DEAL.

But wait, there is more!

Thanks to the GOP tax bill, over 60 mega corparations now pay no tax. FedEx owed more than $1.5 billion in taxes in 2017. After the bill FEDEX owed nothing. Of course, FedEx’s founder and chief executive, Frederick Smith, campaigned and lobbied for the tax cuts. “If you make the United States a better place to invest, there is no question in my mind that we would see a renaissance of capital investment,” at a n August 2017 radio show. hosted by Larry Kudlow, who is now chairman of Trump’s National Economic Council.

Mr. Smith, 75, a former Marine who built FedEx from a small package delivery service into a global logistics giant, was no stranger to pressing for lower taxes. He tried, without success, to get President Barack Obama to cut the corporate rate. But with Mr. Trump’s ascension, the corporate chief began a one-man campaign to convince Washington that now was the moment. He met with the president-elect at Trump Tower on Nov. 17, just days after the election, and appeared alongside the president at official events. In a conference call with analysts the month after Mr. Trump’s election, Alan Graf, FedEx’s chief financial officer, called the prospect of a 20 percent corporate tax rate “a mighty fine Christmas gift.” Mr. Smith teamed up with his competitor, David Abney, the chairman and chief executive of UPS, to push for a tax overhaul, including jointly writing an op-ed in The Wall Street Journal. “Fred and I even jointly had some meetings about this with key people, and we were both pushing pretty hard,” Mr. Abney said in a recent interview. (New York Times)

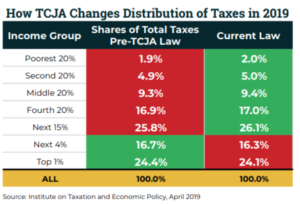

While the tax gift to the ultra rich’ own taxes is modest, companies they own saved upward of $100 billion more on their taxes than analysts predicted when the law was passed. Companies that make up the S&P 500 index had an average effective tax rate of 18.1 percent in 2018, down from 25.9 percent in 2016, according to an analysis of securities filings. More than 200 of those companies saw their effective tax rates fall by 10 points or more. Nearly three dozen, including FedEx, saw their tax rates fall to zero or reported that tax authorities owed them money. (New York Times)

Trouble is the Trump GOP Tax Cut IS Sneaky. It did make a modest decrease in tax income of the ultra rich, but far more important was the decrease in taxes on corporations like FEDEX. Since these companies often pay NO TAXES, personal income hidden in a corporation is never taxed until the stock is sold. Another reason we need a weatlh tax.

After President Trump signed the $1.5 trillion tax cut into law, FedEx reaped big savings,’ The shipping giant went from an effective tax rate of 34 percent in fiscal year 2017 to less than zero in fiscal year 2018. The US government now owed Frederick Smith money!

What did Fred do with that money? Instead of investing it he increased his wealth by issueing share buy backs to the shareholders! Mr. Smith made tax free money as long as he did not sell his now more valuable stock! THE TRICK WORKS

A New York Times analysis shows “that the companies that received the biggest tax cuts increased their capital investment by less, on average, than companies that got smaller cuts. ” NY Times article. A FEDEX spokesman said “FedEx invested billions in capital items eligible for accelerated depreciation and made large contributions to our employee pension plans, “These factors have temporarily lowered our federal income tax, which was the law’s intention to help grow G.D.P., create jobs and increase wages.” NY Times article.

So, now the stock market is up .. all untaxed wealth for the very rich. BUT this appears to be a sugar high. Trump’s cuts helping to push economic growth to 2.5 percent for the the first year and fueling the boost in hiring. But the impact dwindled quickly and now the mnaufacturing secor is in a recession. That may matter little to the ultra rich because the tech sector and services, esp. health care, contue to grwo. BUT it is bad news in the long term for workers. Waht will matter is the loss of the trade war, as now seems certain given over a year of failed negotiations and Trump’s abporgation of existing trade treaties. Aparna Mathur, an economist at the conservative American Enterprise Institute, writes “ (The tax cut) did provide a short-term boost, but it wasn’t the big response that many people expected,”

FEDEX is a good example of the sugar high. A year after the tax cut, FEDEX company cut back employee bonuses and is offering buyouts to decrease the number of employees. FEDEX also spent $240 million less on capital investments than it predicted begore the bill passed.

Eight months after Congress passed the law, Mr. Trump celebrated the tax cuts by hosting Mr. Smith and other business leaders at a dinner at his Bedminster, N.J., golf club. He singled out Mr. Smith several times, bantering with him about a term paper that Mr. Smith had written while a student at Yale. The paper formed the basis for the creation of FedEx. (New York Times)