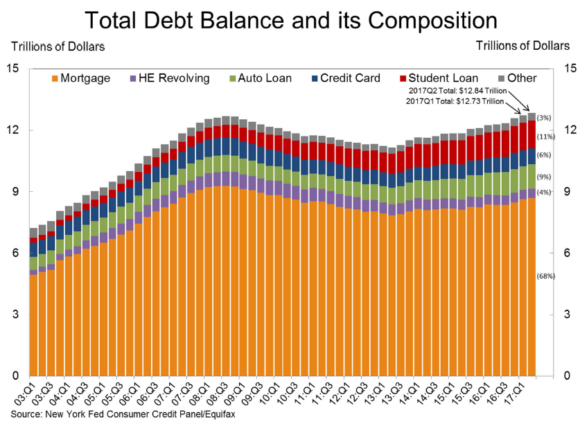

While U.S. household debt has regained 2008 levels, there is more income servicing that debt, and credit quality is better. “This means that the new peak in household debt is far less worrisome than the levels we saw in 2008 and more likely part of a much-needed boost in overall debt servicing more productive economic purposes.” Read story here.

Also, while there are concerns about rising default rates in the subprime auto lending sector, auto loans are a much smaller part of the credit universe than mortgages, so trouble in that sector can’t have the same far-reaching effects on the economy that bad mortgages did.