So here in ohso liberal Seattle, we have no state income tax .. mostly we pay real estate taxes. That might be OK, except we also offer yuge tax breaks to folks who own expensive homes.

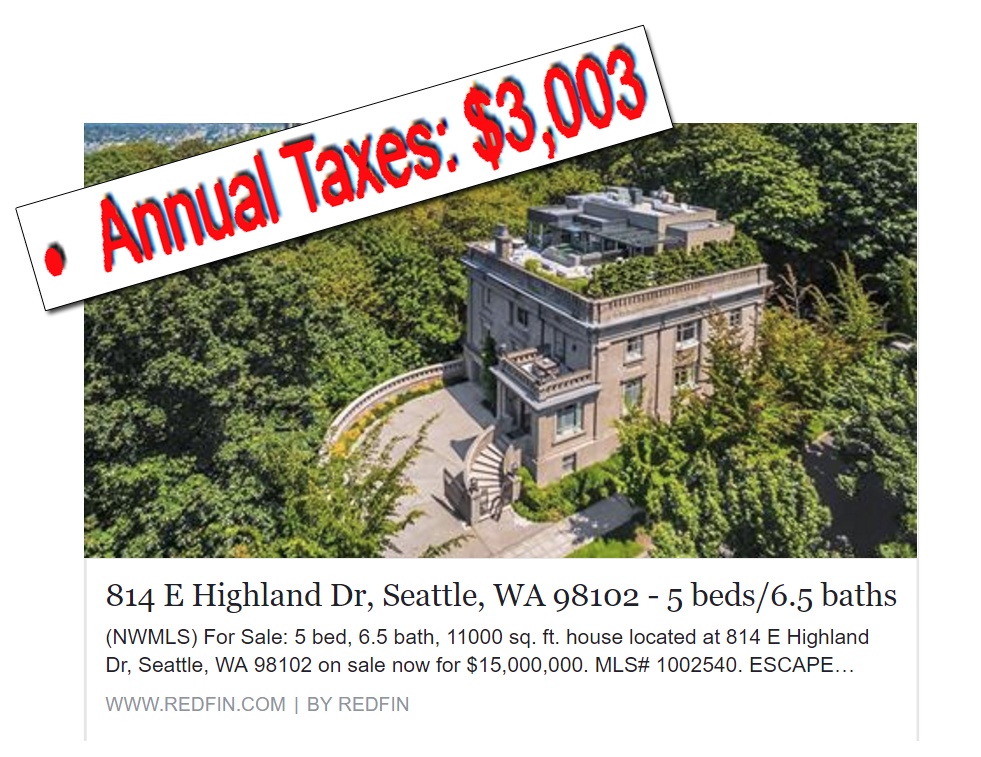

I live in a damn pricey neighborhood. A few months ago I posted about a house downstreet has been for sale for $15,000,000. The rich folks had gotten away with pay8ng no taxes. Now they are going to pay some taxes … after years where they should have paid about $350,000. But the place is still getting a 80% discount!

Like Trump, our local real estate magnates, in this case a Vulcan exec, gets yuge tax breaks. David Capobianco, who owns the home engineered his brilliant tax bill by using an obscure law that allows owners of historic structures to deduct remodeling casts of old houses as “historic restoration. ” To make it worse, the King County Assessor’s Office hadn’t visited the home in years. Its last assessment valued the massive mansion and its park like grounds at $2.6 million, even though the owners “invested” $9.7 million in the property.

To make matters worse the owner David Capobianco, pretty muched gutted the house as part of his “historic remodeling.” After claiming that he and his wife had “left no stone unturned (to) restore the home to its former glory,” “historic might be true of this was a remodel back to the Jetsons:

The Capobianco five-bedroom mansion now features a rooftop terrace with a spa, a gym inside and chic ultramodern features. Even the assessor says, “Wilson said the couple essentially gutted the entire inside and kept only the historic facade. The classic interior is gutted, replace with what I think of as mini mansion moderne. The assessor said. “(The remodelling) was to make it more modern, sleek and comfortable for the occupants.” I would add tasteless.

The new tax bill is just a fraction of what the Capobiancos would habe otherwise paid. Without the massive tax credit, which is still in place, the  owners would have faced a total bill of about $340,000 for the five-year span through 2017.assessor is sending a bill of $50,613 for taxes for this year and the last three years to the owners, former Vulcan executive David Capobianco and his wife, Rosangela. Next year’s bill will be $20,000 or more.

owners would have faced a total bill of about $340,000 for the five-year span through 2017.assessor is sending a bill of $50,613 for taxes for this year and the last three years to the owners, former Vulcan executive David Capobianco and his wife, Rosangela. Next year’s bill will be $20,000 or more.

In other words, they’re still getting an 80 percent discount off their total property-tax bill over that five-year span and the home will not be retroactively charged for the zero tax bills enjoyed in 2011 and 2012, as the assessor is only able to charge back taxes for three years. Without the tax credit, they would have paid $38,000 for those two years, based on the old, lower assessed valued.

Tax break explained (Seattle Times)

That tax break was large enough to wipe out the entire property-tax bill because the assessed value of the mansion was so low.

After reviewing the renovation permits, viewing the interior photos of the listing (officials weren’t allowed inside the home) and examining the exterior. So even after subtracting the $6.4 million renovation cost, that leaves a “taxable” home value of $1.4 million. If the home sells for its $15 million list price, the owners would get their multimillion-dollar renovation costs back, and then some.

Through a spokesman, the Capobiancos declined to comment. They are moving to Houston, where David is now the CEO of Five Point Capital Partners, a firm that invests in and operates energy companies.

The 11,000-square-foot home’s list price hasn’t changed. It remains the priciest in Seattle, and it’s been on the market for 2½ months.