“Outside China, pessimism has been growing about the ability of the colossus to sustain its rapid growth. Worriers are paying particular attention to excessive capacity, investment and debt.”

“Outside China, pessimism has been growing about the ability of the colossus to sustain its rapid growth. Worriers are paying particular attention to excessive capacity, investment and debt.”

Francis Fukyama, Reagan’s house intellectual, wrote a compelling book claiming that social evolution inevitably led to the combination of democracy and a market economy. Fukyama’s compelling idea was that democracy provides a mechanism that optimizes human leadership and shapes a free market economy that is as good as it can be for all.

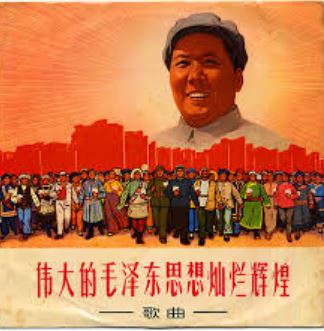

We are in the process of finding out is Fukuyma was wrong. China is not a democracy, it is a state corporation. China, Inc.’s growth has amazed and fueled the world now for over two decades. Martin Wolf at the Financial Times asks if this growth is now at end. “Outside China, pessimism has been growing about the ability of the colossus to sustain its rapid growth. Worriers are paying particular attention to excessive capacity, investment and debt.”

Wolf’s article accepts the corporate idea. He writes of China the way any business reporter might write of Microsoft or GM, that is of a challenge to the corporate leadership to adapt to changing times. The assumptions he makes are that the Communist Party, China’s corporate management, will pull the country through the transition to a consumer led economy able to sustain growth at a reasonable rate. The current goal is 7.5%, a lot less than recent times bit perhaps enough to finance the continued growth of the middle class if we accept the argument that the Party is committed ot doing “the right thing.”

Wolf explains the 7,5% growth rate as a result of an excess capacity driven by both the weakness of the world economy and by a decrease in the supply of young workers moving from the peasantry and willing to work for minimum urban wages.

His biggest worry is of a credit bubble. Viewing China as a corporation, Wolf points out that local authorities, the equivalent of bank managers for Goldman Sacks, have financed an unending growth in capacity, housing, and infrastructure with borrowed money that may never be repaid. At the same time the ability of the world to finance this by buying stuff “made n China: is limited while the costs of resources other than labor or growing … water and oil are not indigenous to China.

Still, Wolf is optimistic. He quotes China, Inc.’s management as being committed to a blueprint that includes a transformation of “imperative and administrative governance” to “governance by law” and market forces. While most Americans may find this sort of talk from politicians to be gobbledy gook, its should be familiar to anyone who reads a corporate annual report. Wolf was in China to hear Premier Li Keqiang and vice-premier Zhang Gaoli and was impressed that the CEOs ” make good sense both on economic and environmental fronts.”

Perhaps Wolf is correct … perhaps the corporate model can avoid the need for the sort of crash capitalist models in free societies need when their markets change. If so, Fukuyama will have been prove wrong.