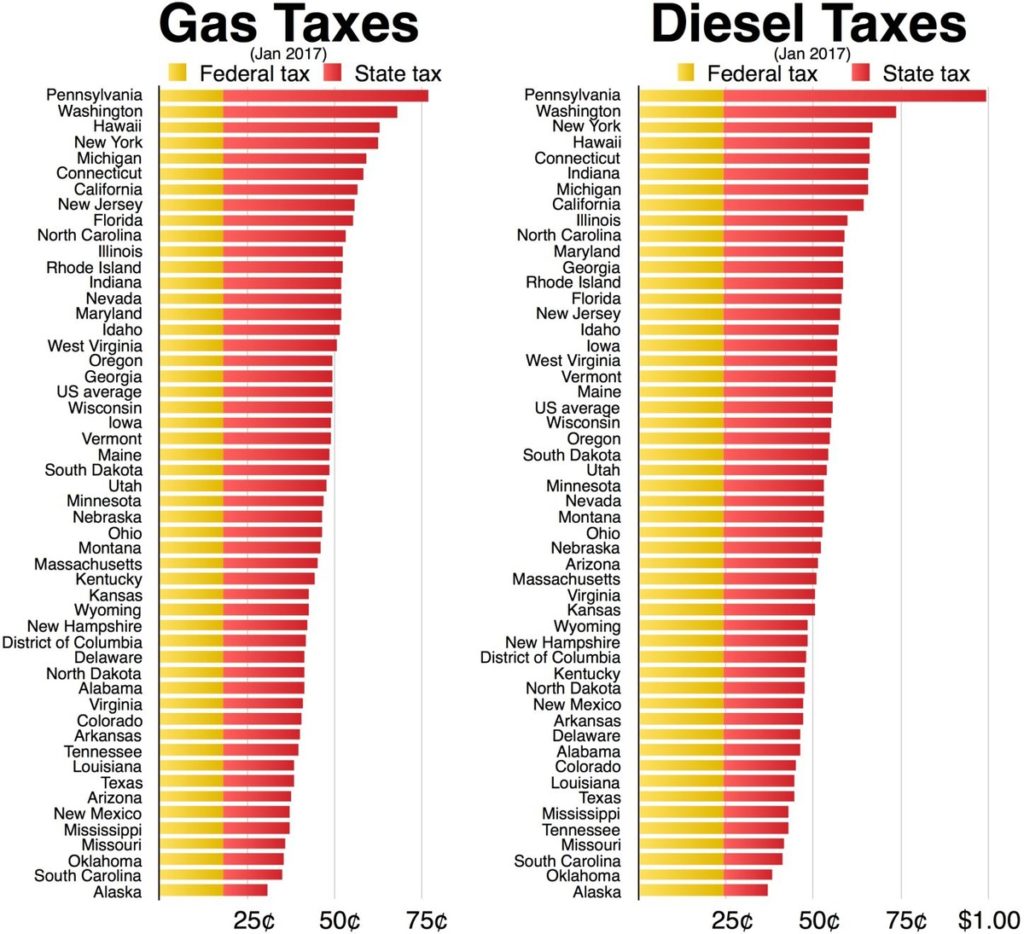

President Trump is making some noise about raising the federal gas tax, which has been static at 18.4 cents a gallon since 1993 because it’s not indexed to inflation. It’s lost about 2/3rds of its purchasing power since then. Now, Trump wants to repair America’s crumbling infrastructure, which is a sensible investment in America’s economic productivity. (President Obama wanted to, too, at a time we really needed the jobs, but was prevented from doing so by GOP obstructionists.) The problem is figuring out how to pay for it. Historically, we’ve financed roads with fuel taxes, and there’s no reason for not doing so now. The gas tax probably is the closest thing we have to a true user tax — those who use the roads pay for them. What could be more fair? But the devil is always in the details, and it’s not hard to imagine Trump screwing this up. For example, by diverting the additional gas tax revenues to paying for his border wall. By the way, if you’re wondering how various states rank in gas taxes, take a look at the chart below. Washington has the country’s second highest combined federal-state gas tax, after Pennsylvania, followed by Hawaii, New York, and California. Alaska has the lowest and other oil-producing states like Oklahoma, Texas, and Louisiana are down there, too.