Oil is an extremely complicated industry. There are different grades and qualities of oil, with different refining requirements, and widely varying production costs. Oil is used not just for fuel, but also chemical feedstock, and for manufacturing everything from plastics to fertilizer. Things like Cheap Oil Delivery are also needed for home heating oil in people’s homes. Even if oil was completely replaced as fuel by renewables, there would remain a significant market for oil.

Natural gas tends to be sold in regional markets with regional pricing, because it’s not as transportable as oil. (Pipelines cross continents, but not oceans.) Oil is a global market, priced in U.S. dollars, under two major trading classifications: Brent and WTI. You can see ways to invest in it on sites like https://www.energyfunders.com/, and it is a popular choice for first-time investors due to the ease of access.

Brent is the leading benchmark for pricing Atlantic Basin crudes, and is used for about two-thirds of the world’s global oil trade. WTI (which stands for “West Texas Intermediate”) is used for price settlements at the Cushing, Oklahoma, oil hub and is the dominant price benchmark in U.S. oil futures trading. Brent and WTI prices are seldom the same, reflecting differences in quality and transportation costs. Brent oil ends to cost more than WTI oil; as of Dec. 31, 2014, Brent was $57.55 and WTI was $53.27.

Over time, oil prices are determined by supply and demand, more or less; but traditional supply-demand economic models can’t explain the sudden 50% drop in oil prices, because there’s been no recent supply or demand shock. At present, supply and demand, both roughly 92 million bpd (barrels per day), are almost in balance. According to the Saudis, the oversupply is about 600,000 bpd, or less than 1% of total production and consumption. So the oil price decline must have other causes.

Nominally, it happened because of how oil is traded. . Generally speaking, producers don’t sell oil directly to buyers; most oil is sold through the futures markets, so it’s really traders who set prices. Conspiracy theories abound as to what roiled the oil futures markets, but I’m not going to go into them here. All I’ll say is, Obama should be on his knees praising Allah, because he’s looking like a rose while a long list of America’s adversaries squirm.

The question we’re interested in, and the topic of this post, is where oil prices go from here. The possibilities are: (1) go lower, (2) stay where they are now, or (3) go back up.

A lot of people, i.e. nearly everyone on the planet, believes oil prices are manipulated. They probably are. So, whether oil goes lower, stays the same, or goes back up will be decided by whoever is manipulating oil prices, which of course everyone thinks is the Saudis. They’re probably right. So, what are the Saudis up to?

As I said, I’m not going to dig into conspiracy theories here. Their objectives probably are pretty pedestrian. They’re most likely sending a signal to the markets that it isn’t safe to invest in oil development projects with production costs above $50 or so, in order to reduce future supply. Two or three years of sub-$60 oil should be pretty convincing to banks and corporate execs looking at projects with costs well above that. And they’re probably focused more on market share than price per barrel. Currently, Saudi Arabia supplies about 10% of the world’s oil, and they don’t want their market share to fall below that. So they’ll cut prices as low as necessary to maintain that market share.

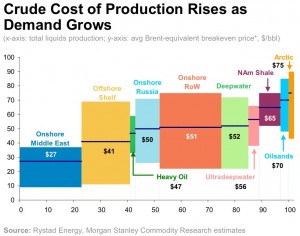

Nearly all experts agree the long-term price trend for oil is upward, simply because the world is using up cheap oil and the newer sources are all more expensive. The world’s oil supply is a mix of cheap and costly oil; the world’s aging supergiant fields with low production costs can’t keep up with demand and are gradually depleting. So, in the future, oil will have to cost more.

On the other hand, the price drop won’t be a two or three month phenomenon, because it takes much longer for supply to respond to price. Oil production is characterized by sunk costs. Most of the investment is spent upfront, before any oil is produced, and once you’ve invested millions in drilling a well, you’re going to produce oil from that well even if the project loses money, because you need the cash flow to recover the drilling costs, and withholding that oil from the market reduces your cash flow to nothing. For this reason, U.S. fracked oil with finding and production costs in the neighborhood of $60 per barrel will continue to flow out of the ground from already-drilled wells, even if the oil price goes to $40, $30, or $20. The impact of low oil prices will be on the not-yet-drilled projects that get shelved. Indeed, U.S. drilling permit applications are down by 40% since summer.

It’s unlikely this price war will kill off the U.S. fracking revolution. It’s true that fracked wells deplete rapidly, with declines rates as high as 80% or 90% within two years (compared to about 2% to 4% a year for a typical conventional oil well), which means frackers have to keep drilling to keep oil flowing. But frackers are rapidly reducing their per-barrel costs, thanks to technology improvements and moving up the learning curve, so the U.S. fracking industry probably could survive a prolonged period of $40 oil. Canadian tar sands and deep offshore and arctic development are more likely to be the victims of low oil prices.

Someone, probably the Saudis, almost certainly is playing games with oil prices, but for the above reason, the conventional belief that their target is North American fracking probably is wrong. Take a look at the chart below, then figure out which oil production is most expensive, and therefore will get taken out first.

Due to the sunk-costs nature of the business, it will take about 18 to 24 months for the price war against high-production-cost oil to work through the system. We’re probably looking at two or three years, possibly longer, of low oil prices. There’s no telling how low the Saudis will take prices before stopping. Their production costs are under $10, and they have enough cash reserves to see them through several years of sub-$50 oil before they have to start cutting their social spending, so they can push prices a lot lower than $50 if they choose — and they might do that. Some experts are looking for oil to reach $40 or even $30 in 2015, although it probably won’t hold these levels very long.

Beyond that, the thinking on Wall Street, which is populated by very smart and well-informed people, is that when the Saudis decide they’ve beaten up other producers enough, they’ll probably let oil stabilize in a range of somewhere around $80 to $90. That’s a bit below recent pricing, which will help keep development of new supply in check. But the real impact on future supply will be the implicit threat that anyone who invests in high-cost projects could find the Saudis choking the return from those investments again, at any time of the Saudis’ choosing.

That’s very likely what this oil price war is really all about.