President Biden is warming up to a federal gas tax holiday (see story here), but will it help motorists? Or is it just empty election-year politics? Probably the latter.

President Biden is warming up to a federal gas tax holiday (see story here), but will it help motorists? Or is it just empty election-year politics? Probably the latter.

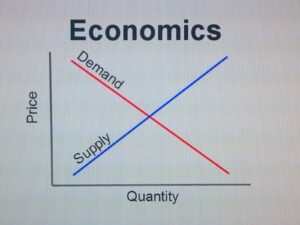

Let me explain why, starting with a simple supply-demand graph from Econ 101.

In a free market, a lower price increases demand but reduces supply; conversely, a higher price reduces demand and increases supply. The pricing mechanism brings supply and demand into balance where the lines on the graph intersect.

If an imbalance exists, price will move up or down until supply and demand balance.

The federal gas tax is 18.4 cents per gallon (24.4 cents on diesel). Let’s say Biden suspends that tax to lower pump prices (so millions of voters won’t be quite so mad at him, even though he had nothing to do with closing 20 U.S. refineries over the last decade).

The supply-demand curve is what has set pump prices where they are. In other words, when all those millions of people came out of pandemic hibernation and started driving again, their demand for gas exceeded the supply, so pump prices will keep going up until they stop trying to buy more gas than refineries can produce. (In case you didn’t know, refining capacity is where the bottleneck is.)

According to economic theory, high prices cause “demand destruction,” i.e., by discouraging consumption until demand comes down to match the available supply. But demand for gas is pretty inflexible, so it takes a lot of upward price movement to get people to drive less.

In theory, higher prices incentivize more production. However, as inflexible as gas demand is, the supply is even more inflexible, because it takes billions of dollars and years of planning and construction to expand refinery capacity, and even then refining companies won’t do it unless they believe the increase in demand is permanent, because otherwise their investment in more capacity becomes an unused asset. This latter point is critical.

So let’s say Biden knocks 18.4 cents off a gallon of gas by suspending the federal gas tax. According to economy theory, this will increase demand, but won’t reduce supply because the lower pump price isn’t coming out of suppliers’ pockets. However, the 18.4 cents isn’t going into their pockets, either, so suspending the gas tax won’t create a profit incentive to increase supply.

All you’ve done is knock the market out of balance by increasing demand without increasing supply. So guess what will happen? As the graph shows, price will come back up until demand and supply are in balance again. In theory, pump prices would rise 18.4 cents, back to where they are now, because that’s where demand and supply intersect. The only thing different will be that the 18.4 cents now goes to suppliers instead of the government road repair fund — most likely as pure profit.

But given those higher profits, won’t suppliers respond by increasing supply? No, because they’ll figure the gas tax holiday is temporary, so they won’t invest in increasing capacity to fulfill the now-even-higher demand because when the gas tax is restored the bump in pump price will destroy that demand.

So, my suggestion is, if Biden suspends the gas tax, consider buying refiner stocks. You won’t get cheaper gas, but you’ll get a slice of their fatter profits to help you pay for it.

Read here: A brief history of gas price swings and their impact on domestic politics.