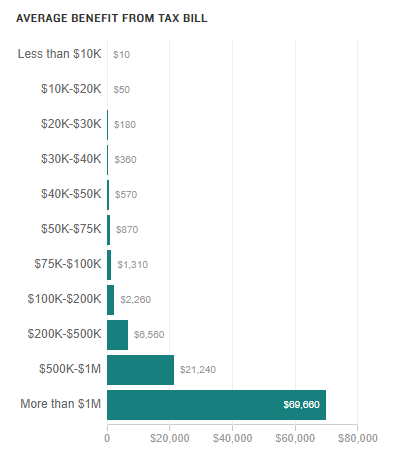

Using data from this chart (click here for source), the average tax cut per $1000 of income is:

If your income is $10,000 or less, then $1 per $1000 of income.

If your income is $20,000, then $2.50 per $1000 of income.

If your income is $30,000, then $6 per $1000 of income.

If your income is $50,000, then $11.40 per $1000 of income.

If your income is $75,000, then $11.60 per $1000 of income.

If your income is $100,000, then $13.10 per $1000 of income.

If your income is $200,000, then $11.30 per $1000 of income.

If your income is $500,000, then $13.12 per $1000 of income.

If your income is $1 million, then $21.24 per $1000 of income.

If your income is $10 million, then $69.66 per $1000 of income.

These figures are very approximate and actual tax savings vary among individuals depending on their circumstances. The purpose of this exercise is to show how the GOP’s tax cuts discriminate against the poor, treat a broad swath of the middle class roughly equally, and are drastically tilted in favor of the rich.