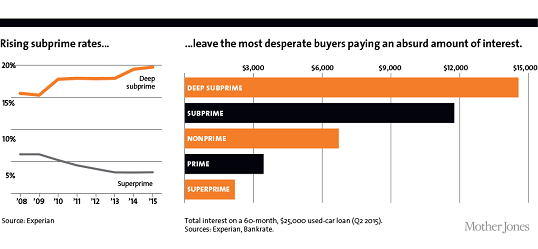

Mortgages comprise 70% of U.S. consumer debt, and autos 7%, see chart here. That’s why subprime auto loans won’t crash the economy the way subprime mortgages did in 2007. But predatory auto lending is growing exponentially, and its primary victims are the poor. The chart below shows how these lenders are fleecing their bad-credit customers who can’t qualify for mainstream auto loans by soaking them with sky-high interest charges. And, of course, repossessing cars is a big part of these sleazy business, too. Read the story here.