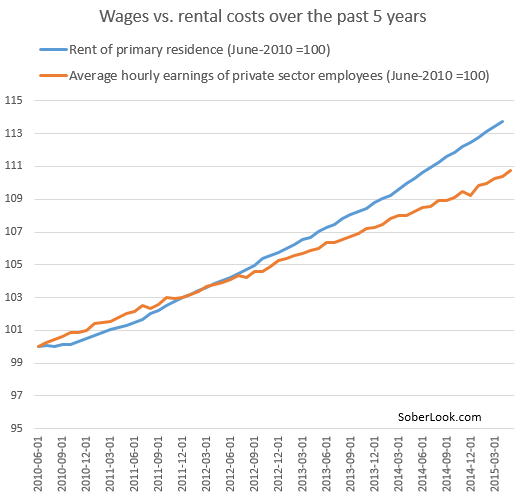

It’s no secret America is facing a new housing crisis. This issue is getting more media play recently. Its roots lie in the collapse of residential construction after the housing crash. Also, changes in employment patterns, an explosion of student debt, and the reluctance of millenials to start families have created a shift in preferences from owning to renting. The result is an acute shortage of all types of housing, but especially rentals, in many areas of the country — especially in fast-job-growth cities like Seattle. This graph illustrates the widening divergence between incomes and rental prices. (Text continues after chart)

It’s a complex problem that defies easy solution. Contributing factors include:

1. Stagnant wages aren’t keeping up with rising rents.

2. Millions of Americans have been pushed out of owned housing into rental housing by foreclosures, job losses, and tighter lending standards and credit availability; millions more are choosing renting over owning because of their need for greater geographical mobility in an economy where fewer jobs are permanent.

3. Jobs and growth are concentrating in urban cores, where land is at a premium, and density considerations favor mass housing over single-family residences.

4. The collapse in construction activity means the housing stock hasn’t kept up with population growth.

5. Shifting social patterns away from family formation, with more people postponing marriage longer or staying single, means more housing units are needed to house a given population.

Proposed solutions have included more public housing, imposing affordable housing mandates on developers (who generally prefer to build for the higher-end market), rent control, more government housing subsidies, and relaxed lending requirements. Many young people can’t buy homes for lack of down payments and inability to qualify for mortgages because they’re burdened with student debt.

One thing is clear: The housing shortage and soaring housing costs (both home prices and apartment rents) can’t be brushed away as a personal problem of those caught up in it, or solved by admonishing them to manage their finances better. Young people, in particular, were set up for financial distress by a society that demands a college degree for most employment paying more than poverty wages and at the same time, through the actions of legislatures, shifted a huge amount of educational costs from taxpayers to students who had no choice but to borrow to have a chance of competing in the finicky job market. America’s new housing crisis clearly is a public policy issue requiring a societal response. What that response will be is up to us as thoughtful citizens and voters. Inaction and relying solely on market forces doesn’t seem like a good option at this point.